A business plan for a medical practice is far more than a formal document for the bank. It is a strategic management tool that helps you plan the foundation or acquisition of your practice in a structured, financially viable, and sustainable way. Especially in the highly regulated and cost-intensive Swiss healthcare system, a well-founded business plan is crucial for long-term success.

This guide follows proven structures, integrates practical, field-tested content, and refers to official resources. At the same time, you receive concrete examples, tables, and checklists so that even without a business background, you know exactly what needs to be done.

What is a business plan for a medical practice and what is it used for?

A business plan for a medical practice systematically describes how your practice will function medically, organizationally, and financially. Typical use cases include:

- Founding a solo or group practice

- Acquisition of an existing medical practice

- Expansion (e.g. additional services, relocation)

In addition to external stakeholders (banks, insurers, authorities), the business plan primarily serves you as a decision-making and management tool.

What belongs in a medical practice business plan?

A complete business plan for a medical practice in Switzerland consists of several clearly defined chapters. The following structure has proven itself in practice and is also expected by banks:

1. Executive Summary: Brief overview for decision-makers

The executive summary summarizes the entire business plan on 1–2 pages. It is often read first and determines whether banks or partners will examine your project in more detail.

It should include:

- Short profile of the physician (specialty, experience, FMH)

- Type of practice (solo practice, dual practice, group practice)

- Location and catchment area

- Investment volume and financing requirements

- Key economic targets (revenue, profit, break-even)

2. Business idea & service offering of the medical practice

Here you describe your medical vision and the specific service offering.

Medical concept

- Specialty areas and subspecializations

- Coverage of primary care vs. additional services

- Billing system (TARDOC, supplementary insurance, self-pay)

Differentiation & positioning

Especially in urban areas, it is important to explain why your practice is needed. Possible differentiating factors include:

- Extended opening hours

- Special consultation hours (e.g. sports medicine, geriatrics)

- Modern infrastructure or digital processes

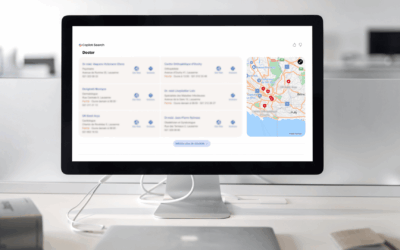

3. Market and competitive analysis: realistically justifying utilization

A central aspect of a medical practice business plan is justifying your utilization assumptions.

Market analysis

Describe the catchment area of your practice:

- Population size and age structure

- Physician density (general practitioners/specialists per 1,000 inhabitants)

- Regional gaps in care

Competitive analysis

Analyze existing practices in the area:

- Number and specialties

- Waiting times and patient volume

- Practice sizes (solo vs. group practices)

Based on this, derive realistic assumptions regarding patient frequency and revenue.

4. Organization, team & roles in the medical practice

A clear organizational structure builds trust with banks and reduces operational risks.

Team structure

Typical roles include:

- Physician (owner or partner)

- Employed physicians

- Medical practice assistants (MPA)

- If applicable, a practice manager or external accounting

Optionally, a simple organizational chart can be included, especially for group practices.

5. Legal structure & permits

In Switzerland, different legal and regulatory requirements apply depending on the canton. It is best to inform yourself in advance on the website of your respective canton. Content that should definitely be included in your business plan includes:

- Legal form (sole proprietorship, LLC, corporation)

- Professional practice license

- Approval for mandatory health insurance (OKP)

- Lease and employment contracts

6. Financial planning in the medical practice business plan

The financial section is the most important part for banks. It should be transparent, realistic, and comprehensible. It is also essential for your own planning to prepare this section thoroughly. The following table shows a simplified example for your business plan:

| Item | Amount (CHF) |

|---|---|

| Investments (equipment, renovation) | 250’000 |

| IT & practice setup | 80’000 |

| Start-up costs & liquidity reserve | 70’000 |

| Total capital requirement | 400’000 |

| Equity | 120’000 |

| Bank loan | 280’000 |

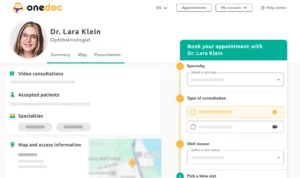

Make sure to research acquisition or takeover costs for specialized medical equipment as well as furniture for your practice. Do not forget the costs for digital applications, such as your practice software or a tool for online appointment booking.

7. Projected income statement: planning costs and revenues

A projected income statement is also an important part of financial planning and describes a forward-looking plan of your income offset against your expected expenses. The projected income statement should be prepared for at least three years and show the expected profits or losses for each year.

Key assumptions you need to explain:

- Number of consultations per day

- Average revenue per consultation

- Personnel and rental costs

- Depreciation and interest expenses

- Insurance (e.g. professional liability insurance, disability insurance, property and business interruption insurance, or accident insurance)

Banks pay particular attention to liquidity development and the break-even point, i.e. the point at which income and expenses balance for the first time or income exceeds expenses for the first time.

How do I plan costs and revenues (projected income statement) in a medical practice?

Start conservatively. Plan with reduced utilization in the first year (e.g. 60–70%) and increase it gradually. Here are some examples to consider in your planning:

- How strong is the competition in my area, and will my practice gain traction quickly?

- Am I taking over a practice with a stable patient base, or do I need to build my reputation from scratch?

- Do I expect seasonal fluctuations in patient volume based on my specialty?

- How do I plan the salary structure of my employees over the first three years?

8. Risks of opening a practice and how to manage them

Show in your business plan that you have considered potential risks and how you plan to mitigate them. This point is particularly important for banks’ confidence in your business capability and reliability. Typical risks when opening a practice include:

- Slower patient acquisition

- Tariff changes

- Staff shortages

For example, consider digital tools such as video consultations, which allow you to acquire patients from other regions at an early stage. In addition, online appointment management can help significantly reduce phone workload, giving you sufficient time for daily practice tasks even during staff shortages.

9. Timeline until practice opening: checklist

In addition to the business plan, create a structured timeline for opening your own practice. This helps you avoid missing important steps and ensures you are well prepared when operations begin. Here is a rough timeline for orientation:

- 12–9 months before: location, business plan, financing

- 9–6 months before: lease agreement, permits, insurance

- 6–3 months before: renovation, IT, staff recruitment

- 3–0 months before: marketing, processes, test operations

Banks & insurance companies: what is required?

You now have everything you need for your business plan. In addition, banks often require further documents for credit approval, including:

- Personal CV and qualifications

- Proof of equity

- Plausible financial planning

FAQs about the medical practice business plan

Is there a business plan template for medical practices?

Yes, there are official templates for your business plan. For example, use the resources of the Swiss government SME portal or AI-supported tools such as the one from unternehmenswelt.de.

How much money is needed to open a practice?

Depending on specialty, location, and whether it is a takeover or a new foundation, investments in Switzerland typically range between CHF 200’000 and 800’000.

Ready to start your own practice

A well-founded business plan for your medical practice creates clarity, security, and negotiating power. It is not a one-time document, but a living management tool for your self-employed medical career in Switzerland.

Sources

- https://www.kmu.admin.ch/kmu/de/home/praktisches-wissen/kmu-gruenden/firmengruendung/erste-schritte/gut-geplanter-start/businessplan/vorlagen-und-muster-zum-erstellen-von-businessplaenen.html

- https://www.aerzteblatt.de/archiv/der-arzt-als-existenzgruender-businessplan-das-muss-rein-773422af-beb4-48b5-bf08-5fdfcaa67a1c